8 Simple Techniques For Estate Planning Attorney

8 Simple Techniques For Estate Planning Attorney

Blog Article

The smart Trick of Estate Planning Attorney That Nobody is Talking About

Table of ContentsEstate Planning Attorney for BeginnersThe Definitive Guide to Estate Planning AttorneyThe 2-Minute Rule for Estate Planning AttorneyThe Estate Planning Attorney Diaries

Estate preparation is an action strategy you can make use of to identify what happens to your properties and obligations while you live and after you die. A will, on the other hand, is a legal record that details just how assets are distributed, who cares for kids and pet dogs, and any other wishes after you die.

The executor additionally has to repay any type of tax obligations and financial obligation owed by the deceased from the estate. Lenders usually have a restricted amount of time from the day they were notified of the testator's death to make claims versus the estate for money owed to them. Insurance claims that are rejected by the executor can be brought to justice where a probate court will have the last word as to whether or not the case is valid.

The 5-Minute Rule for Estate Planning Attorney

After the supply of the estate has actually been taken, the worth of assets determined, and taxes and financial debt settled, the executor will after that look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will come due within nine months of the date of fatality.

Each individual locations their properties in you can try this out the count on and names somebody various other than their partner as the beneficiary. Nevertheless, A-B counts on have actually become less prominent as the estate tax exemption works well for many estates. Grandparents may transfer possessions to an entity, such as a 529 strategy, to sustain grandchildrens' education.

The Ultimate Guide To Estate Planning Attorney

This technique entails cold the value of a possession at its value on the day of transfer. As necessary, the quantity of potential resources gain at death is likewise frozen, permitting the estate coordinator to estimate their potential tax liability upon fatality and far better plan for the settlement of earnings tax obligations.

If sufficient insurance policy proceeds are offered and the policies are effectively structured, any earnings tax obligation on the considered personalities of possessions following the death of a person can be paid without resorting to the sale of possessions. Profits from life insurance policy that are obtained by the beneficiaries upon the fatality of the insured are usually earnings tax-free.

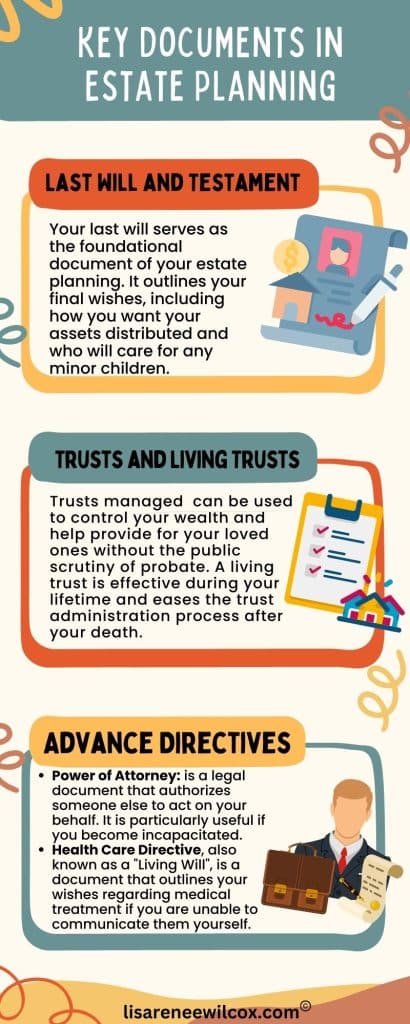

There are specific records you'll require as component of the estate planning procedure. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. However that's not true. Estate preparation is a device that every person can make use of. Estate planning makes it easier for individuals to identify their desires before and after they die. Contrary to what the majority of people believe, it prolongs beyond what to do with assets and liabilities.

The 9-Minute Rule for Estate Planning Attorney

You should begin preparing for your estate as quickly as you have any kind of measurable property base. It's a continuous process: as life proceeds, your estate plan should change to match your scenarios, in line with have a peek here your brand-new click for info goals. And maintain it. Not doing your estate planning can create unnecessary financial problems to loved ones.

Estate preparation is often believed of as a tool for the affluent. Estate preparation is additionally a fantastic method for you to lay out strategies for the treatment of your minor kids and pets and to outline your desires for your funeral and preferred charities.

Applications need to be. Qualified candidates who pass the examination will be formally certified in August. If you're qualified to sit for the examination from a previous application, you may submit the short application. According to the rules, no certification will last for a duration much longer than 5 years. Learn when your recertification application schedules.

Report this page